The Investment Migration Industry Enters its Most Exciting Period, by Dominic Volek

This article was contributed by Dominic Volek

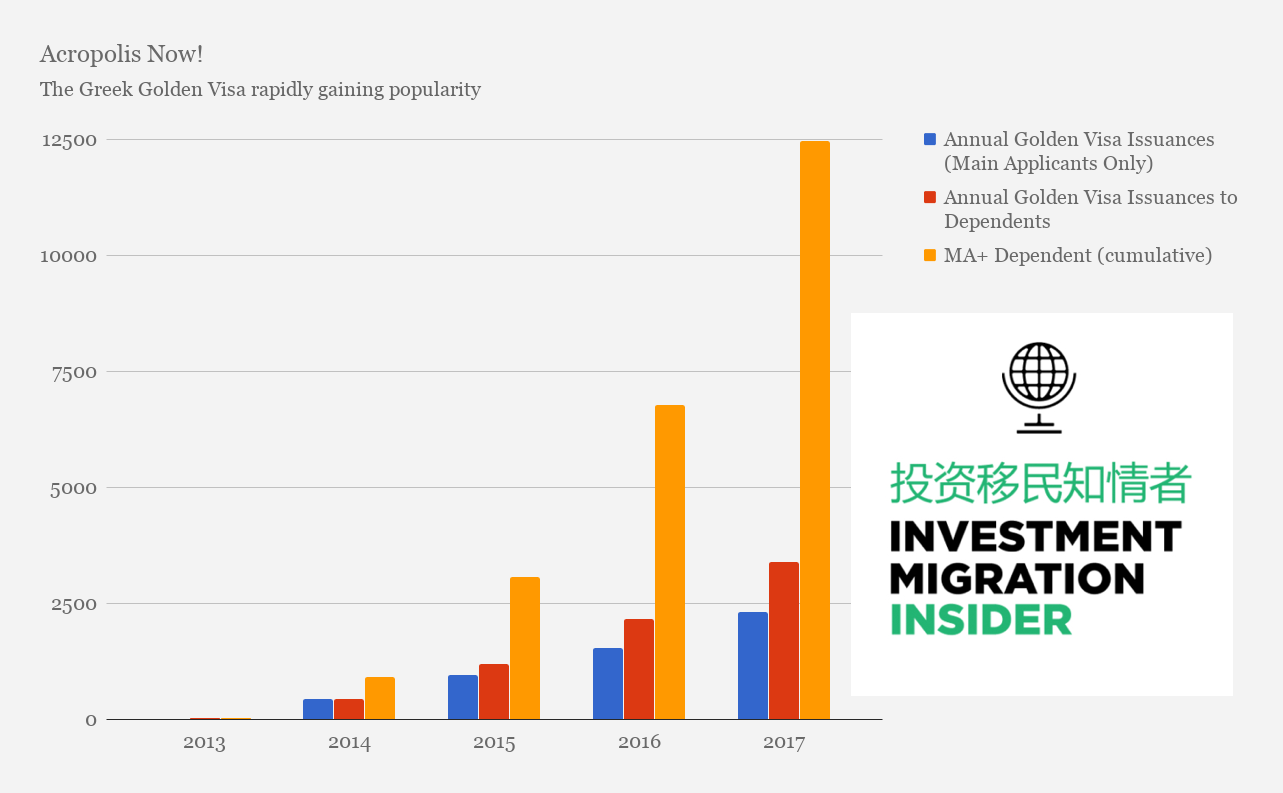

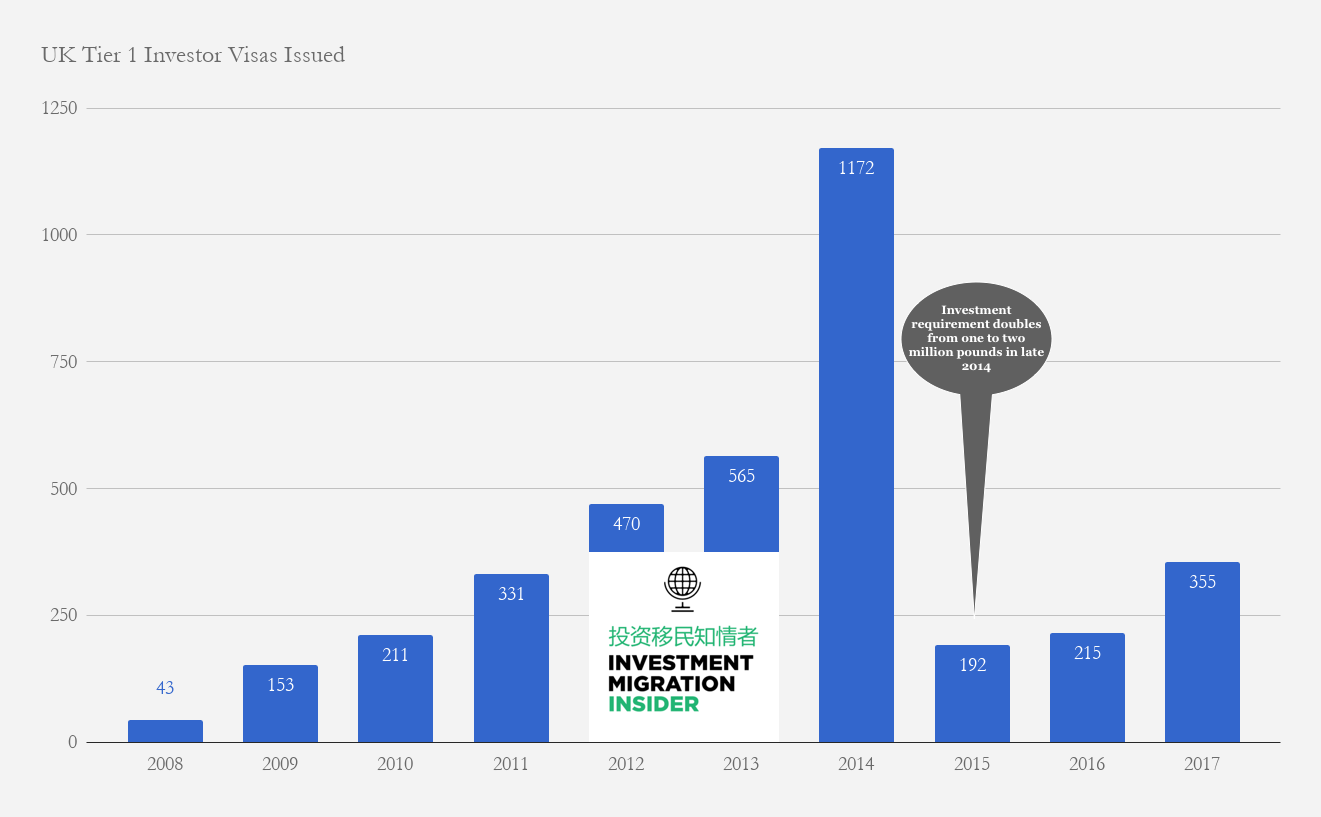

The investment migration industry has entered arguably the most exciting period of its history. Thousands of people are applying for citizenship and residence each year, and by the end of 2017 there were over 30 active and successful programs in existence, with a total of 80 programs available worldwide.

The range and breadth of programs is constantly expanding, with residence and citizenship options now available in most of the major world regions, including the Caribbean, North America, Europe, Southeast Asia, Oceania, and even, most recently, Central Asia.

Citizenship-by-investment has grown into a roughly USD 3 billion industry, while residence-by-investment — slightly more difficult to approximate — most likely encompasses tens of billions of dollars, given the size of the US EB-5 visa market alone.

Read also: Portugal’s Golden Visa Passes 6,000 Approvals for the First Time Show March Data

In addition to its increasing market size, investment migration has also become a lot more visible and accepted, thanks, in part, to the establishment of the Investment Migration Council, the industry’s professional association and self-regulatory body.

Rather than mysterious, rarefied topics off-limits to ordinary citizens, as was largely the case in the industry’s early years, citizenship- and residence-by-investment are now virtually household names, part of every savvy investor’s and wealth manager’s vocabulary.

Hedging sovereign risk

The factors driving the increased demand for alternative residence and citizenship are wide-ranging. In the unpredictable times in which we live, acquiring a second or even a third residence or nationality is seen as an astute move — a sort of wholesale insurance policy that provides the comfort of a ‘plan B’ for individuals and families, hedging them to a great extent against the risks associated with an uncertain future.

Another major pull-factor is, of course, the prospect of expanded global mobility. The need for greater visa-free access to key business and lifestyle regions has grown in tandem with the rapid globalization of the world economy, and being able to travel easily and extensively is now less a luxury than a basic requirement for modern businesspeople.

Investment migration enables wealthy individuals to transcend the constraints imposed on them by their passport and country of origin, tapping into financial, career, and educational opportunities on a global scale.

Citizenship-by-investment in particular also eliminates a great deal of the inconvenience and waiting time surrounding visa applications and passport renewal or replacement processes. Perhaps most importantly, an additional passport can quite literally save a person’s life in times of political unrest, civil war, and terrorism, or in other delicate political situations.

Most residence programs offer a clear and defined route to citizenship, but residence in regions such as the EU is in and of itself a life-altering privilege. EU residents can travel freely within and across member states and can access all the professional, healthcare, educational, and housing benefits available to citizens in a particular country.

Mutually beneficial

Crucially, investment migration is not a one-way transaction. Those who are critical of the industry tend to focus exclusively on the benefits to private clients: they are concerned by what they perceive to be the undue ‘marketization’ of citizenship, and they are distressed by issues of tax evasion and money laundering.

Read also: 6 moronic objections to investment migration (and how CBI/RBI is improving the lives of millions)

While the former concern is rooted in an increasingly old-fashioned attachment to arbitrary determiners of nationality such as birthplace, the latter concern is usually overstated: due diligence mechanisms are incredibly rigorous and strict, with hundreds of exceptionally qualified and upstanding individuals vetted and accepted into programs each year, but the rare highly publicized exceptions to this norm tend to cloud public perception.

More pointedly, skeptics typically disregard the transformational effects that inflows from residence and citizenship programs can have on receiving economies, which become more competitive and internationally relevant as a result. Foreign direct investment brings in capital to both the public sector — in the form of government donations, tax payments, or treasury bond investments — and the private sector — in the form of investments in businesses, start-ups, or real estate.

The economic benefits are cumulative: receiving states tend to experience rapid growth in the real estate sector, accompanied by growth in the construction industry and among local businesses, plus increased liquidity in the commercial banking system and job creation. There are also various intangible benefits tied to granting citizenship to people from other countries, who bring diversity, scarce skills, and rich global networks.

Read also: IMF Deems Malta IIP a Key Economic Contributor, Naysayers Still Find a Way to Criticize

Given the growth and developmental potential of citizenship and residence program, it is hardly surprising that the number of states offering or exploring investment migration is on the rise. Qualifying investors can now become citizens of Antigua and Barbuda, Cyprus, Grenada, Malta, and St. Lucia, to name just a few options, or obtain residence in countries such as Australia, Canada, Portugal, Singapore, Thailand, the United Kingdom, and the United States.

There are still many countries where it makes sense to start new programs, so the industry looks set to continue to thrive and diversify.

Do your own due diligence

The growing number of programs available, combined with the rising number of high-net-worth individuals globally (and in developing countries especially), has led to a burgeoning industry, with new service providers setting up shop on a regular basis. Although this progression provides applicants with more choices, the plethora of service providers and program options also presents a potential danger for investors.

The barrier to entry for ‘agents’ in this space is not especially high, and clients need to be especially cautious when seeking out a service provider to help them with the application process. Not all intermediaries have the client’s best interests at heart, which places the burden on individuals to do their own due diligence before contracting with third parties.

Related: Chartered Investment Migration Practitioner – The IM Industry Needs a CFA-Equivalent

Similarly, not all programs are equally legitimate and credible, so clients need to do their own research before committing to a particular investment route. This is not necessarily a bad thing, however, because it encourages a more educated and empowered investor population that understands the investment migration process from beginning to end rather than relying entirely on external parties.

Before deciding on who to engage, investors should investigate each company’s track record, industry experience, and application success, to ensure that they avoid the disappointment caused by empty promises, unrealistic timelines, and, ultimately, wasted time and money. The first port of call should be an established, reputable advisory firm, even if this means paying a little extra for the assurance of accurate advice and sound guidance.

The consultation process should include an in-depth analysis of the various options available based on an investor’s circumstances and requirements. Clients should be provided with personalized assistance in taking the appropriate course of action and navigating what is often a very complex process. It is crucial that clients’ information is kept confidential, particularly at the point of submission, where some service providers will inevitably use third parties or other agents.

High industry standards

Programs with thorough due diligence processes that allow adequate time for the government to process applications should be viewed in a positive light. Although the path to citizenship or residence is generally slightly longer in such cases, following a meticulous process guarantees the integrity, sustainability, and therefore longevity of the program as well as the reputation of the passport itself.

Malta has the strictest due diligence mechanisms in the world for its Malta Residence Visa Program and its Malta Individual Investor Program and has in many ways set the standard in this regard. Along with Austria and Cyprus, it is the only country in the EU that offers pure citizenship-by-investment.

In a recent interview with the Investment Migration Insider, Peter S. Vincent, General Counsel for Thomson Reuters, said, “If we’re looking for a model, not just for the European Union but for the entire world, I would look to a country like Malta.”

It is worth nothing here that, because of the stringent screening process in place, the number of people who are actually granted citizenship through investment each year is rather small: in Europe, the figure stands at roughly 700, which is less than 0.01% of the total number of naturalizations processed annually (about 800,000).

The very few individuals and families who do obtain passports through investment programs have gone through significantly more due diligence checks than anyone who has simply lived in a certain European country for enough time to be eligible for citizenship. Applicants must provide police clearance certificates and undergo thorough source-of-wealth and source-of-funds checks. Program countries also go to external due diligence agencies such as Thomson Reuters or Kroll that run their own advanced checks.

There is no denying that the investment migration process is a lengthy and laborious one, but it is precisely this rigor that lends credibility and that will ensure sustainability going forward.

Dominic Volek is a Member of the Group Management Board and Head of Southeast Asia at Henley & Partners

If you would like to submit an article for publication, send an email to cn@imidaily.com

Christian Henrik Nesheim is the founder and editor of Investment Migration Insider, the #1 magazine – online or offline – for residency and citizenship by investment. He is an internationally recognized expert, speaker, documentary producer, and writer on the subject of investment migration, whose work is cited in the Economist, Bloomberg, Fortune, Forbes, Newsweek, and Business Insider. Norwegian by birth, Christian has spent the last 16 years in the United States, China, Spain, and Portugal.